IDC Opinion:

The intent behind a computerized maintenance management system (CMMS) is to automate, improve, and ultimately anticipate maintenance needs. This IDC MarketScape helps organizations evaluate the CMMS application market landscape. It is a competitive market, and buyers have their pick of vendors.

From the product perspective, any system an organization considers should have reactive, planned, and condition-based maintenance capabilities. Depending upon how you will use the system, IDC suggests looking at additional functionality for spare part inventory, vendor management, work scheduling, inspections, and reporting. Organizations must also think about key areas that distinguish SaaS CMMS application vendors today, which are relationship building, configurability, mobility, location intelligence, predictive maintenance, and vision.

Relationship Building

SaaS turns a CMMS software deployment into a multiyear relationship. Purchase decision makers should look for a vendor that feels as much a cultural fit for their organization as a technical fit. Many customer references talk about whether they trust the vendor to deliver on their promises and provide the best experiences. Some end users expressed delight with the little things that their customer success manager does for them or when a random feature that they requested shows up on the product road map. Often, it comes down to the commitment and expertise of the vendors’ staff, how they guide customers during and after implementation to avoid common pitfalls, and the way they treat customers when it’s time for renegotiating contracts.

Configurability

Applications should readily conform to an organization’s workflows, nomenclature, and roles. Organizations should have the ability to quickly modify existing fields, add new fields, and rearrange fields on different views, as well as report on custom data points. Further, a modern CMMS provides mechanisms for altering out-of-the-box workflows, such as defining approval processes, generating email alerts, and sending invoices to a financial application. Purchase decision makers should evaluate how much can be configured via the user interface or low-code tools without writing custom code. When a system is truly configurable, all customers can be on the same code base, but still have the product work the way they want. Otherwise, organizations end up adjusting procedures to fit a rigid application or paying ongoing professional services fees to customize and maintain workarounds. In fact, these are two of the main reasons customers gave for being dissatisfied with a CMMS application.

Mobility

Mobile is increasingly important because technicians want to complete everything onsite and not have to return to a desk at the end of the day to key in data. Further, the COVID-19 pandemic imposed physical restrictions that quickly drove organizations to more remote maintenance operations. Five years ago, most customers wanted a simple mobile maintenance app for technicians to open, assign, and close work. Now technicians want the option to do almost everything they can do on a computer on a mobile device as well, but still have it be easy to use. Initially, this favors vendors that mobile enabled their SaaS product for access on any device because new features are automatically available. Greater investment in mobile experiences will be a strategic imperative for vendors in this area as more and more activities go remote.

Location Intelligence

One emerging frontier is the integration between maintenance systems and location-related external data and location intelligence analytics. Knowing and using the location of a technician, asset, work order, or issue adds rich context to the preservation of physical assets and equipment. Potential digital transformation use cases include assigning work to the nearest technician, tracking the location where an asset is deployed, and overlaying 3D models with real-time location information. For example, technicians can use an indoor wayfinding to navigate to points of interest or geospatial visualizations to understand areas impacted by outages or natural disasters. There are exciting possibilities but also challenges with privacy and cultural acceptance. Organizations will want to harness the promise of location intelligence while not letting the potential get ahead of the practical.

Predictive Maintenance

Many vendors promote predictive maintenance when they actually deliver what IDC classifies as condition-based maintenance. With condition-based maintenance, companies can monitor certain real-time data from IoT endpoints, such as runtime, temperature, or pressure. Then the maintenance team defines rules to automatically trigger work orders when data is outside acceptable thresholds. This delivers significant productivity gains for organizations still relying on reactive and time-based planned maintenance and is a valuable step in advancing maintenance operations. Predictive maintenance goes to the next level and applies artificial intelligence (AI) and machine learning (ML) algorithms to a range of historic and live data points to create models. Maintenance software then anticipates events such as when equipment is likely to fail, downtime may occur, or spare parts will run out. Going one step further, vendors are exploring making recommendations or automating actions based on predictive models. This is certainly an area to watch as CMMS vendors take a page from enterprise asset management (EAM) application providers already making inroads in predictive maintenance.

Vision

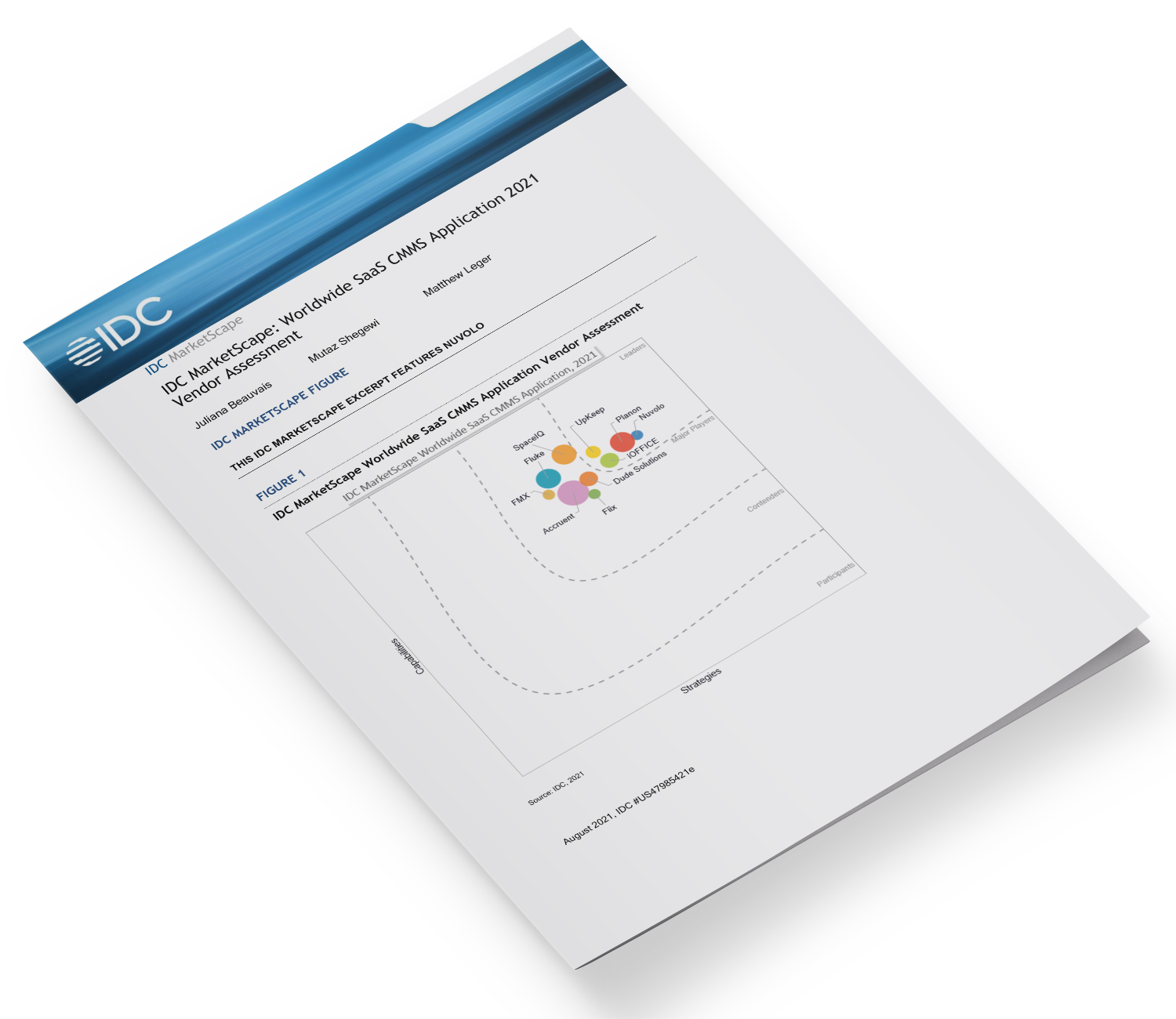

This IDC MarketScape evaluates the vendors, not just their products. CMMS vendors are fairly close together on their capabilities but vary on their strategies (refer back to Figure 1). Some are effectively leveraging partnerships and a broader ecosystem to bring more value to customers, while others are building predictive analytics, doubling down on IoT, or updating their cloud architecture and delivery. The road maps and strategies shared with IDC demonstrated a wide range of what vendors believe customers will prioritize in the future. A product road map is a set of commitments to customers and a statement about where the software provider is focusing its energy. While many vendors are hitting on a few key areas, only some are pulling it all together in a comprehensive and compelling vision. This is one differentiator between vendors in the Major Player versus Leader category.